When it comes to selling assets, understanding the difference between capital and ordinary gains and losses isn't just tax savvy—it's financial wisdom. In this article, we will explore how these classifications impact your tax obligations and how strategic planning can lead to significant tax savings. Whether you're dealing with investments, real estate, or other valuable holdings, knowing these rules can enhance your financial outcomes.

Key Categories of Gains and Losses

- Capital Gains and Losses Capital gains and losses typically stem from the sale of capital assets. Under federal tax law, these assets exclude:

- Inventory, meaning property held primarily for sale to customers in the ordinary course of the taxpayer's business,

- Business receivables,

- Business real and depreciable property, including rental real estate and

- Certain intangible assets, such as copyrights and letters or memoranda held by the taxpayer for whom they were prepared or produced.

Literary, musical, and artistic compositions usually fall outside the capital asset category, though exceptions exist, allowing for elections that treat certain copyrights as capital assets. Additionally, certain business asset transactions, like those involving real estate, may yield net Section 1231 gains, treated similarly to long-term capital gains for tax purposes.

- Ordinary Gains and Losses arise from selling non-capital assets and can include certain business assets. The result can be net Section 1231 losses, treated as ordinary losses, which can have different tax implications compared to capital losses.

Tax Rate Variations and Their Impact Understanding the different tax rates applicable to capital and ordinary gains is crucial. Net long-term capital gains (LTCGs) are taxed at a maximum rate of 20%, significantly lower than the maximum 37% rate for ordinary gains. When subject to the Net Investment Income Tax (NIIT), these rates can increase to 23.8% and 40.8%, respectively.

2024 Taxable Income Thresholds for Gains:

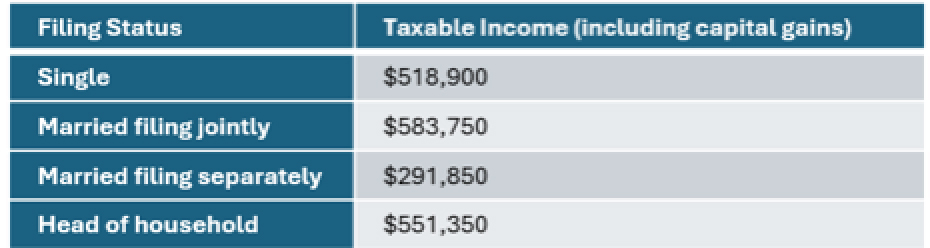

- For Net LTCGs:

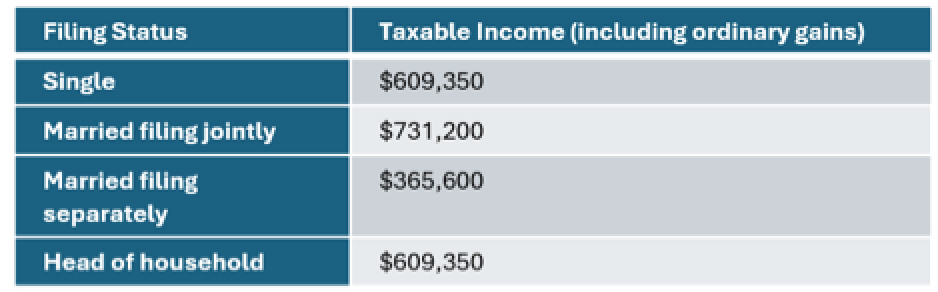

- For Ordinary Gains:

These thresholds underscore the benefits of qualifying for LTCG rates, where possible, to reduce tax liabilities.

How to Classify Business Real Estate

Classifying business real estate correctly is crucial for tax planning. Preferential tax rates apply only to net LTCGs and net Section 1231 gains from dispositions of eligible assets. Property held primarily for sale to customers as part of regular business operations is classified as inventory and excluded from these favorable tax rates. The U.S. Tax Court uses several factors to determine whether real property is inventory, including:

- The nature of the property's acquisition,

- The frequency and continuity of property sales,

- The nature and extent of the taxpayer's business,

- The taxpayer's sales activities related to the property,

- The substantiality of the transaction.

Additional factors include the purpose of the property's acquisition, duration of ownership, efforts to sell the property, frequency of sales, development efforts to increase sales, use of a business office for sales, control over sales representatives, and the time devoted to property sales. No single factor is decisive, but the frequency and substantiality of sales often play a critical role, as frequent sales usually indicate the property is held for sale rather than investment. Important: Taxpayers bear the burden of proving their classification. If they fail to meet this burden, the IRS prevails in disputes over classification.

The Importance of Loss Deductibility

Understanding how losses are deducted can significantly affect your tax planning. The distinction between capital losses and ordinary losses is particularly noteworthy:

- Capital Losses: Deductible up to $3,000 annually for individuals, regardless of marital status, with any excess carried forward to future tax years.

- Ordinary Losses: Generally fully deductible in the year they occur, providing a potential immediate tax relief.

This difference is crucial for effective tax management, particularly in strategizing around the sale of assets and managing potential tax liabilities.

Closing Thoughts and Next Steps

Understanding the complexities of taxable gains and losses requires a nuanced understanding of tax laws and strategic planning. At Reynolds + Rowella, we're committed to helping you optimize your financial decisions through expert tax advice and tailored strategies. Whether you aim to minimize your tax burden or need guidance on classifying and handling your assets, our team is here to assist you.

Ready to take control of your tax strategy?

Contact Reynolds + Rowella today to schedule a consultation. Our expert advisors are eager to help you navigate your tax planning precisely and confidently, ensuring you make the most informed decisions for your financial future.

Reynolds + Rowella is a regional accounting and consulting firm known for a team approach to financial problem solving. As Certified Public Accountants, our partners foster a personal touch with our clients. As members of DFK International/USA, an association of accountants and advisors, our professional network is international, yet many of our clients have known us for years through the local communities we serve. Our mission is to operate as a financial services firm of outstanding quality. Our efforts are directed at serving our clients in the most efficient and responsive manner possible, delivering services that exceed the expectations of those we serve. The firm has offices at 90 Grove St., Ridgefield, Conn., and 51 Locust Ave., New Canaan, Conn. For more information, please contact Elizabeth Bresnan at 203.438.0161 or email