As we move through the summer months, now is an opportune time to assess your small business’s financial health and explore strategies to reduce your 2024 federal income tax bill. Fortunately, it appears that no significant unfavorable federal tax changes will take effect next year, which means the 2024 tax planning environment is relatively stable. By taking proactive steps before year-end, you can position your business for maximum tax efficiency. Here are some strategies to consider.

Timing Business Income and Deductions For businesses structured as pass-through entities—such as sole proprietorships, S corporations, partnerships, and LLCs taxed as sole proprietorships or partnerships—your share of income is taxed at your rate. A common year-end strategy is to defer income to the next year while accelerating deductible expenses into the current year. This approach is particularly effective if you expect to be in the same or a lower tax bracket in 2025. On the other hand, if you anticipate being in a higher tax bracket next year, you may want to accelerate income into 2024 and delay deductible expenses to take advantage of the lower current-year tax rates.

Maximizing Depreciation Tax Breaks Depreciation deductions can significantly reduce your business income, making it wise to maximize these deductions within the current tax year. The Section 179 depreciation deduction allows small to midsize businesses to write off the entire cost of qualifying assets in the year they are placed in service. For 2024, the maximum Sec. 179 deduction is $1.22 million, with a phaseout threshold of $3.05 million in qualifying assets. Additionally, 60% first-year bonus depreciation is available for eligible property placed in service during 2024, though this is scheduled to decrease in the coming years. Depending on your tax situation, you may depreciate assets over time rather than claiming a large first-year deduction.

Establishing a Tax-Favored Retirement Plan If your business doesn’t already sponsor a tax-favored retirement plan, this might be the right time to set one up. Current tax rules allow for significant deductible contributions, which can reduce your taxable income. For instance, self-employed individuals can contribute up to 20% of their net self-employment income to a SEP-IRA, with a maximum contribution of $69,000 for 2024. Other options, such as SIMPLE-IRAs, defined benefit pension plans, and 401(k) plans, may also be worth considering, depending on your business’s needs.

Maximizing the QBI Deduction The Qualified Business Income (QBI) deduction remains a key tax break for owners of pass-through entities. It allows you to deduct up to 20% of your QBI, subject to income-based restrictions. Strategic planning is essential to optimizing this deduction, as actions like claiming large first-year depreciation deductions or making substantial retirement plan contributions can inadvertently reduce your allowable QBI deduction. Working closely with your tax advisor will help ensure you maximize this benefit.

With the current federal tax rules likely remaining in place through 2025, now is the time to implement these midyear tax planning strategies. Consult a Reynolds + Rowella tax advisor to tailor these strategies to your business needs. Our experts are ready to help you navigate the complexities of tax planning, ensuring that your business is optimized for maximum tax efficiency and positioned for success in 2024 and beyond.

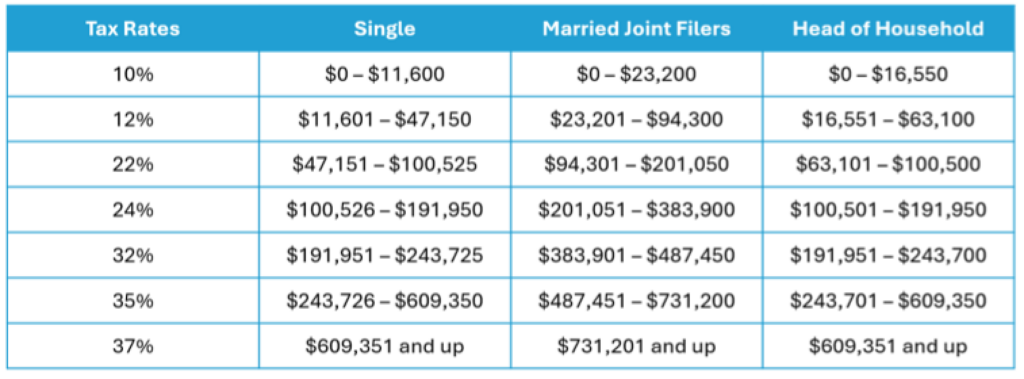

2024 Tax Rates and Brackets for Individuals

Income from pass-through entities — including sole proprietorships, S corporations, partnerships, and limited liability companies taxed as sole proprietorships or partnerships — is reported on the owners' personal tax returns for the year and taxed as ordinary income. Here's a summary of the federal tax rates on ordinary income for 2024.

2024 Federal Tax Rates on Ordinary Income

Assuming the current tax regime remains in place for 2025, the brackets listed above will be adjusted for inflation.

Reynolds + Rowella is a regional accounting and consulting firm known for a team approach to financial problem solving. As Certified Public Accountants, our partners foster a personal touch with our clients. As members of DFK International/USA, an association of accountants and advisors, our professional network is international, yet many of our clients have known us for years through the local communities we serve. Our mission is to operate as a financial services firm of outstanding quality. Our efforts are directed at serving our clients in the most efficient and responsive manner possible, delivering services that exceed the expectations of those we serve. The firm has offices at 90 Grove St., Ridgefield, Conn., and 51 Locust Ave., New Canaan, Conn. For more information, please contact Elizabeth Bresnan at 203.438.0161 or email.