Unlock the Benefits of a 0% Tax Rate on Capital Gains and Dividends

Are you aware that you could potentially pay no federal income tax on certain investment income? This intriguing possibility applies to net long-term capital gains (LTCGs) and qualified dividends, depending on your taxable income. Ideal for individuals with marketable securities and real estate investments outside of tax-favored retirement accounts, this article explores how you could qualify for this beneficial rate—even if your earnings are higher than you might think.

Understanding Tax Brackets for LTCGs and Dividends

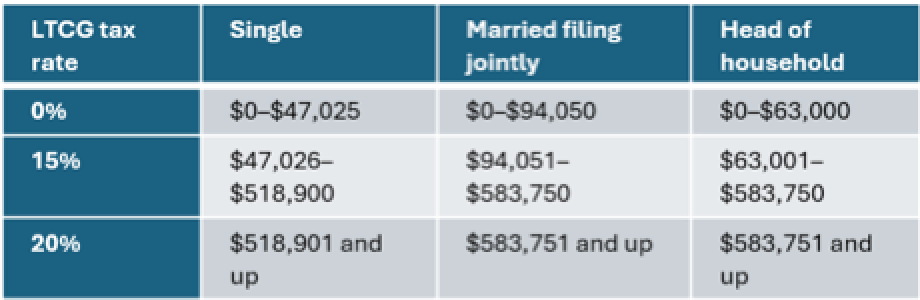

Your eligibility for the 0% tax rate on LTCGs and qualified dividends is determined by your taxable income, which is your adjusted gross income minus any deductions, whether standard or itemized. Here are the specifics for the tax brackets in 2024:

These rates are expected to be adjusted for inflation in 2025, provided the tax regulations remain constant.

Who Stands to Gain from the 0% Tax Rate?

This tax benefit isn't just for the ultra-wealthy or those with minimal income. Many middle-class families and individuals can also qualify for the 0% rate. For instance:

- Married Couple Example: Consider Brittany and Brian, a married couple with two dependents, planning to take the standard deduction of $29,200 in 2024. They could earn up to $123,250 in adjusted gross income—including LTCGs and dividends—and still benefit from the 0% tax rate, with their taxable income calculated at $94,050.

- Single Filer Example: Steven, a single taxpayer with no dependents, can take a standard deduction of $14,600. If his adjusted gross income, including LTCGs and dividends, is up to $61,625, his taxable income would calculate to $47,025, squarely placing him in the 0% bracket.

Itemizers might find even more room to maneuver, with the potential for higher adjusted gross incomes while remaining within the 0% threshold.

Strategies to Extend the 0% Advantage

If your earnings exceed these brackets, consider how you might help others. Transferring appreciated assets to lower-income family members could allow them to sell the assets and pay no tax on the gains, assuming a holding period of over a year. Gifting dividend-paying stocks is another approach; if the dividends are within the recipient's 0% bracket, they would also be exempt from federal tax.

Important Considerations for Gifting

Gifting can be a powerful tool for managing estate sizes and tax liabilities. The annual gift tax exclusion in 2024 allows you to give away up to $18,000 per recipient without any federal gift or estate tax consequences. For married couples, this amount doubles to $36,000. Such strategic gifting can significantly reduce the size of your taxable estate while benefiting your recipients now.

Ready to optimize your investment and tax strategies?

While the 0% tax rate on net LTCGs and qualified dividends is a fantastic opportunity for many, it's not guaranteed to last indefinitely. Legislative changes could potentially alter or eliminate this benefit. It's wise to discuss your specific situation with a tax advisor who can help you plan effectively, ensuring you and your loved ones make the most of current tax laws. At Reynolds + Rowella, our team is ready to assist you with personalized advice and strategic insights tailored to your unique financial situation. Contact Reynolds + Rowella today to explore how we can help you achieve your financial goals with savvy tax planning. Top of Form Bottom of Form

Reynolds + Rowella is a regional accounting and consulting firm known for a team approach to financial problem solving. As Certified Public Accountants, our partners foster a personal touch with our clients. As members of DFK International/USA, an association of accountants and advisors, our professional network is international, yet many of our clients have known us for years through the local communities we serve. Our mission is to operate as a financial services firm of outstanding quality. Our efforts are directed at serving our clients in the most efficient and responsive manner possible, delivering services that exceed the expectations of those we serve. The firm has offices at 90 Grove St., Ridgefield, Conn., and 51 Locust Ave., New Canaan, Conn. For more information, please contact Elizabeth Bresnan at 203.438.0161 or email.